Welcome to the August issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Merger review activity in 2024 has increased slightly from 2023, including 14 merger reviews completed in July 2024 compared to 13 in July 2023. Considered on a year-to-date basis, the Bureau has completed only 106 merger reviews through the end of July 2024, 6% more than the number completed in July 2023 (100) and 18% fewer than the number completed in July 2022 (130).

- The Bureau publishes its Deceptive Marketing Practices Digest regarding environmental claims.

- The Bureau officially launches its market study into the Canadian airline industry.

Merger Monitor

July 1 – July 31 Highlights

- 28 merger reviews published, 14 merger reviews completed

- Primary industries of completed reviews: manufacturing (21%); real estate and rental and leasing (21%); finance and insurance (14%); mining, quarrying and oil and gas extraction (14%)

- 9 transactions received an Advance Ruling Certificate (64%), 5 transactions received a No Action Letter (36%)

- Zero consent agreement (remedy) filed; zero judicial decisions filed

January – July 31 Highlights

- 117 merger reviews published, 106 merger reviews completed

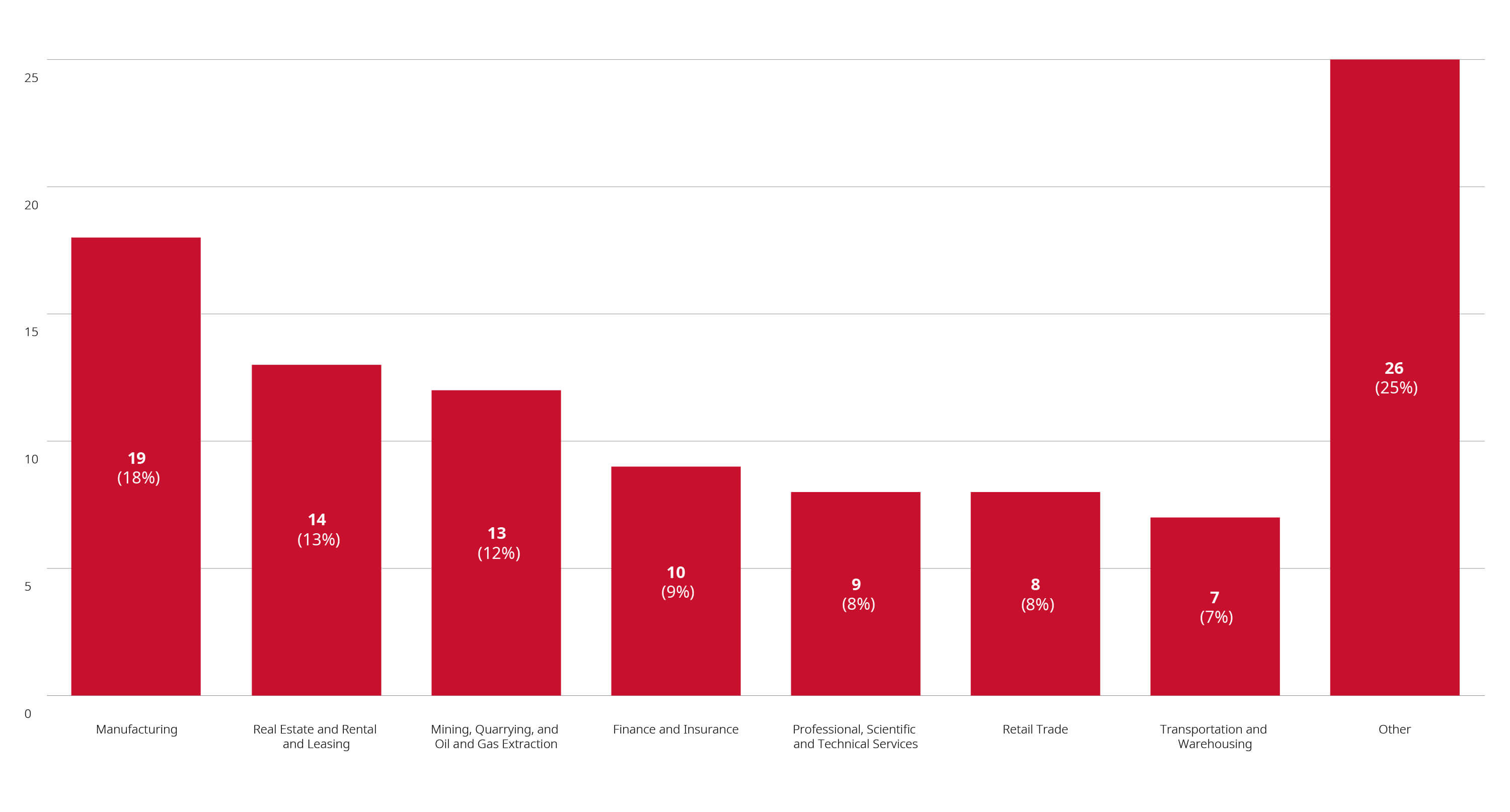

- Primary industries of completed reviews: manufacturing (18%); real estate and rental and leasing (13%); mining, quarrying, and oil and gas extraction (12%); finance and insurance (9%); wholesale trade (8%); professional, scientific and technical services (8%); retail trade (8%)

- 57 transactions received a No Action Letter (54%), 44 transactions received an Advance Ruling Certificate (42%) and two transactions were resolved through other means

- Two consent agreements (remedies) filed; one judicial decision filed

Merger Reviews Completed Year to Date Through July 31, 2024 by Primary Industry

Enforcement Activity

Bureau Obtains Court Order to Advance Investigation into Kalibrate’s Gas Pricing Services

- On July 24, 2024, the Bureau announced that it had obtained a federal court order to advance its investigation into Kalibrate Canada’s (Kalibrate) consultation, data and pricing services. The Bureau’s investigation relates to how Kalibrate provides pricing guidance to gas station operators, as well as visibility on their competitors. The Bureau is considering whether Kalibrate’s products have an adverse effect on competition between gas stations in Canada. The court order requires Kalibrate to produce records and written information relevant to the Bureau’s investigation.

Non-Enforcement Activity

Bureau Requests Feedback on Competitor Property Controls Guidance

- On August 7, 2024, the Bureau requested comments from Canadians on its preliminary enforcement guidance for competitor property controls following recent changes to the Competition Act. The preliminary guidance includes the Bureau’s initial interpretation of how these changes impact its approach to competitor property controls and aims to help compliance with the law. Interested parties can submit feedback and raise issues through the Bureau’s online feedback form by October 7, 2024. All submissions will be published on the Bureau’s website (unless the provider requests it to be kept confidential).

Bureau to Host Summit on Competition and Artificial Intelligence in September

- On July 30, 2024, the Bureau announced that it will be hosting “Canada’s Competition Summit 2024: Market Dynamics in the AI Era” (Summit) on September 16, 2024. The Summit will focus on exploring the current artificial intelligence (AI) landscape, the impacts that AI has on competition across markets, and the international and domestic regulatory approaches to AI and competition.

Bureau Officially Launches its Market Study into Canada’s Domestic Airline Industry

- On July 29, 2024, the Bureau announced that it had officially launched its market study into competition in domestic air passenger services across Canada. As part of this study, the Bureau intends to examine the state of competition in Canada’s airline industry; the barriers to entry and expansion in the domestic airline industry; and the impediments that Canadians face when making informed air travel decisions. Interested parties can provide their input using the Bureau’s feedback form or by emailing the Bureau. The Bureau will accept submissions until August 31, 2024.

Bureau Publishes the Deceptive Marketing Practices Digest – Volume 7 on Environmental Claims

- On July 22, 2024, the Bureau published the most recent volume of its Deceptive Marketing Practices Digest (Digest), focusing on environmental representations. The Digest follows the adoption of amendments to the Competition Act prohibiting the making of untested or unsubstantiated claims about the environmental benefits of a product or business (i.e., “greenwashing”). In the Digest, the Bureau broadly defines “environmental claims” as any representation related to the environment that has been made for the purpose of promoting a product or business interest. Furthermore, the Bureau defines “greenwashing” as claims that make a business or its products sound “greener” than they actually are. For more details regarding the Digest, see our July 2024 bulletin Competition Bureau Launches Consultation on Greenwashing Enforcement Guidance.

Bureau Seeks Feedback on Competition Act’s New Greenwashing Provisions

- On July 22, 2024, the Bureau launched a public consultation, asking interested parties to provide feedback on the new greenwashing provisions of the Competition Act. Interested parties can provide submissions by September 27, 2024, by emailing the Bureau. All submissions will be published on the Bureau’s website (unless the provider requests it to be kept confidential). For more details regarding the new provisions, see our July 2024 bulletin Competition Bureau Launches Consultation on Greenwashing Enforcement Guidance.

Investment Canada Act

Cultural Investments

Q4 2023 Highlights

- One reviewable investment approval and five notifications filed (four for acquisitions and one for the establishment of a new Canadian business)

- Country of origin of investor: Japan (33%); United States (17%); China (17%); Germany (17%); United Kingdom (17%)

2023 Highlights

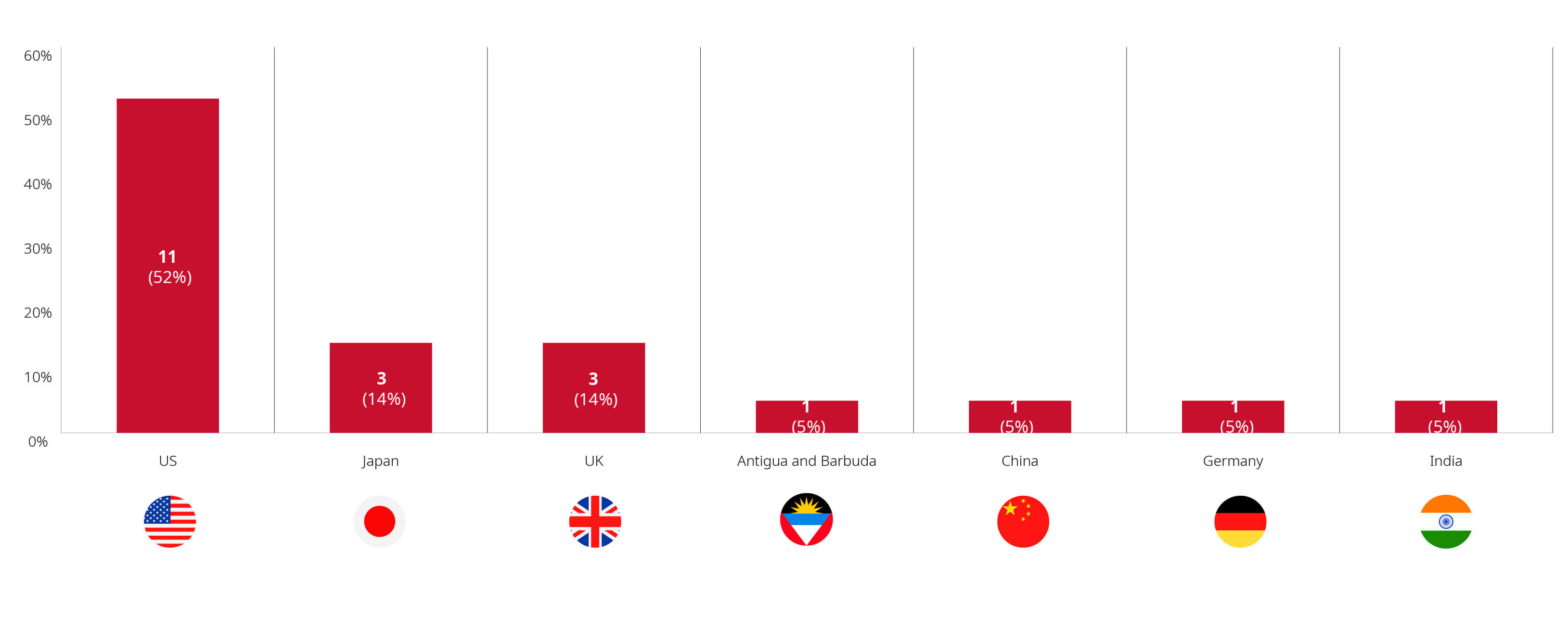

- Five reviewable investment approvals and 16 notifications filed (11 for acquisitions and five for the establishment of a new Canadian business)

- Country of origin of investor: United States (52%); Japan (14%); United Kingdom (14%); Antigua and Barbuda (5%); China (5%); Germany (5%), India (5%)

Non-Cultural Investments

June 2024 Highlights

- 81 notifications filed (58 filed for acquisitions, 23 for the establishment of a new Canadian business)

- Country of ultimate control: United States (57%); United Kingdom (9%); India (5%); France (4%)

January – June 2024 Highlights

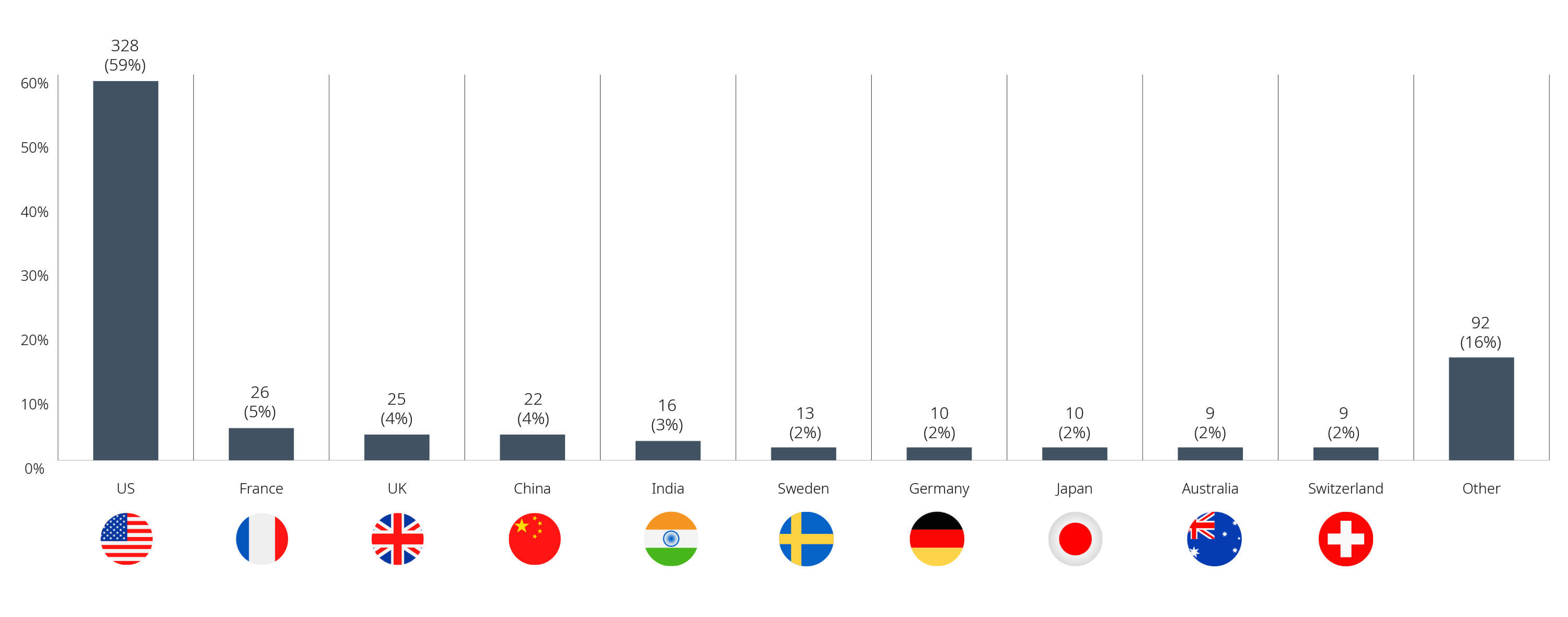

- Two reviewable investment approvals and 558 notifications filed (417 for acquisitions and 141 for the establishment of a new Canadian business)

- Country of ultimate control: United States (59%); France (5%); China (4%); United Kingdom (4%); India (3%)

Blakes Notes

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

- Browse our Competition Act Amendments page for insights on navigating the recent amendments.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at communications@blakes.com.

© 2025 Blake, Cassels & Graydon LLP