Welcome to the November issue of Blakes Competitive Edge, a monthly publication of the Blakes Competition, Antitrust & Foreign Investment group. Blakes Competitive Edge provides an overview of recent developments in Canadian competition and foreign investment law, including updates on enforcement activity by the Canadian Competition Bureau (Bureau), recent initiatives and key trends.

Key Highlights

- Cineplex appealed the Competition Tribunal’s decision in Commissioner of Competition v. Cineplex Inc.

- Merger review activity in 2024 slightly increased compared to 2023, with the Bureau completing 169 merger reviews through the end of October 2024. This figure is 5.5% more than the number completed through the end of October 2023 (159) and slightly greater than the number completed through the end of October 2022 (168).

- The Bureau announced a review of its Merger Enforcement Guidelines.

Merger Monitor

October 1 – October 31 Highlights

- 27 merger reviews announced, 22 merger reviews completed

- Primary industries of completed reviews: manufacturing (29%); real estate and rental and leasing (19%); utilities (10%); mining, quarrying, and oil and gas extraction (10%); administrative and support, waste management and remediation services (10%)

- Ten transactions received a No Action Letter (50%), eleven transactions received an Advance Ruling Certificate (45%), and one transaction was resolved through other means

- Zero consent agreements (remedies) filed; zero judicial decisions filed

January – October 31 Highlights

- 183 merger reviews announced, 169 merger reviews completed

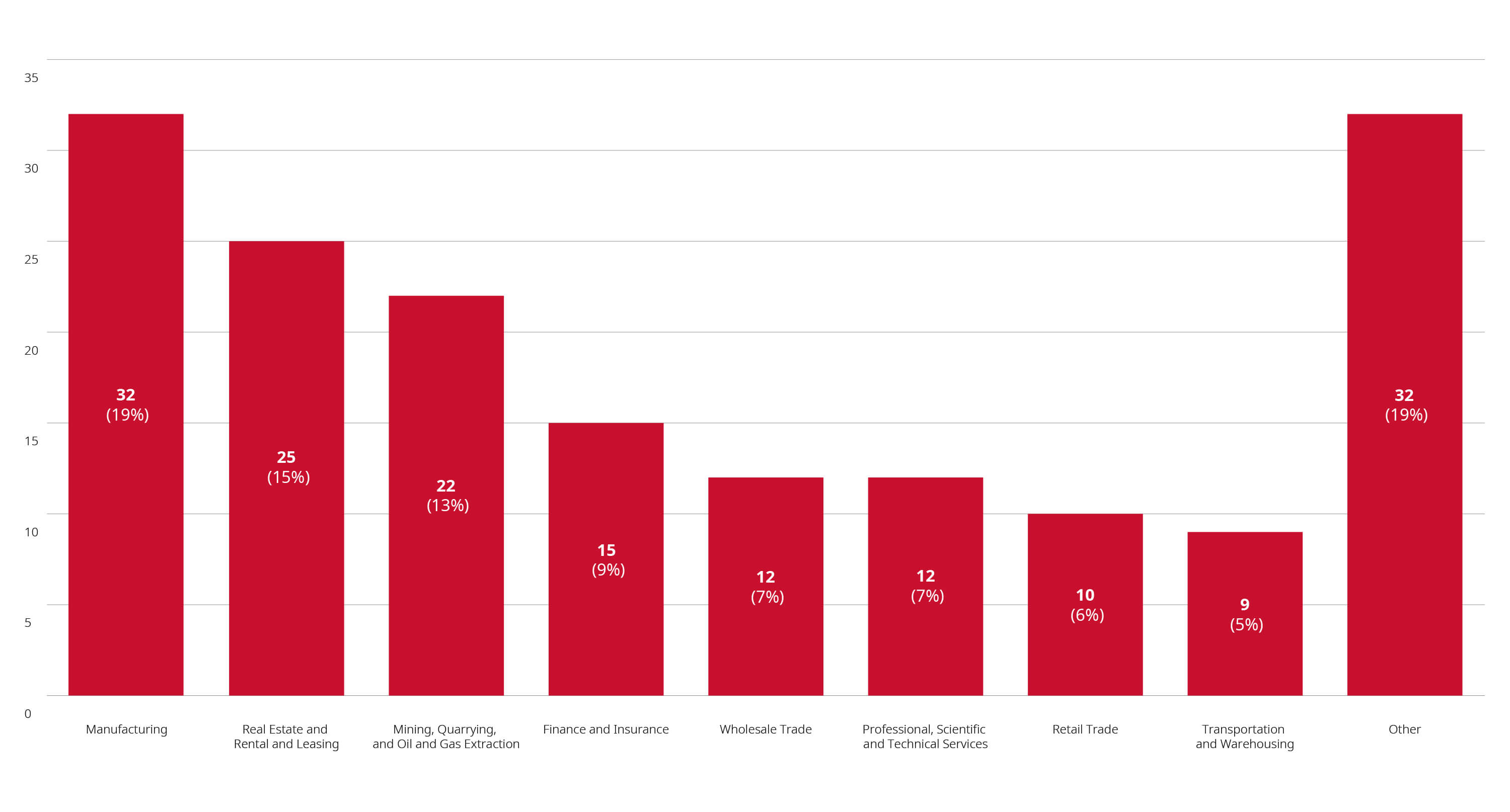

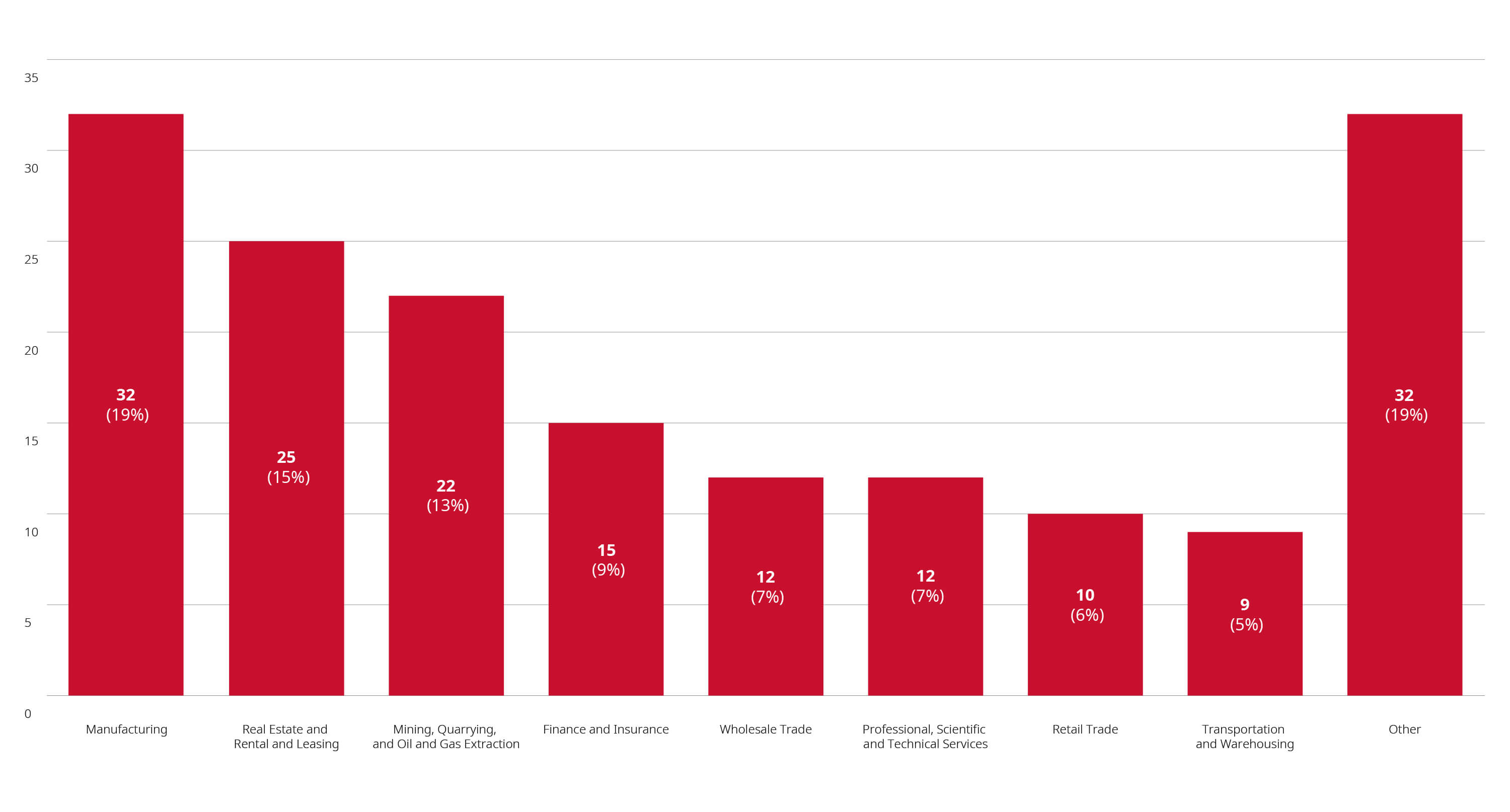

- Primary industries of completed reviews: manufacturing (19%); real estate and rental and leasing (15%); mining, quarrying and oil and gas extraction (13%); finance and insurance (9%); wholesale trade (7%); professional, scientific and technical services (7%)

- 84 transactions received a No Action Letter (50%), 78 transactions received an Advance Ruling Certificate (46%) and three transactions were resolved through other means

- Two consent agreements (remedies) filed; one judicial decision filed; one transaction was abandoned by the merging parties

Merger Reviews Completed Year to Date Through October 31, 2024, by Primary Industry

Enforcement Activity

Cineplex Appeals the Competition Tribunal’s Drip Pricing Decision

- On October 23, 2024, Cineplex filed a Notice of Appeal with the Federal Court of Appeal in response to the Competition Tribunal’s September 24, 2024 decision in Commissioner of Competition v. Cineplex Inc. In this decision, the Tribunal ruled that Cineplex engaged in drip pricing for making false or misleading representations about the price of its movie tickets on its website and mobile application. For more information on the Tribunal’s decision in Commissioner of Competition v. Cineplex Inc, please see the Blakes Competitive Edge: October 2024 Update.

Non-Enforcement Activity

Bureau Announces Review of its Merger Enforcement Guidelines

- On November 7, 2024, the Bureau announced that it will be conducting a review of its Merger Enforcement Guidelines and is seeking public feedback. The Merger Enforcement Guidelines were last updated in 2011, and the Bureau seeks to revise them to ensure that they are reflective of the current state of Canadian competition law. The announcement was accompanied by a discussion paper containing areas of emphasis that the Bureau seeks to revise its guidance on. Among other things, this includes (1) increases in market share or concentration; (2) market definition; (3) anti-competitive effects; (4) monopsony power and labour markets; (5) the digital economy; (6) non-price effects and privacy; and (7) innovation and dynamic competition. Public submissions can be made until January 12, 2025 through an online feedback form, and are published on the Bureau’s website, or kept confidential upon request.

Bureau Publishes its 2023-2024 Annual Report

- On October 30, 2024, the Bureau published its annual report detailing the Bureau’s enforcement and advocacy activities throughout the 2023-2024 fiscal year ended March 31, 2024. Among other items, the Bureau noted that it had commenced 200 merger reviews and concluded reviews of 190 transactions. This reflects a slight decline in merger review activity in comparison to the 2022-2023 fiscal year, in which the Bureau commenced 202 reviews and concluded 208 reviews. With respect to non-merger enforcement activity, the Bureau completed and closed 56 investigations, whereas in 2022-2023, 57 investigations were commenced and 47 were closed.

Bureau Seeking Feedback on New Guidance for Market Studies

- On October 23, 2024, the Bureau announced that it is seeking public feedback on an updated edition of its Market Studies Information Bulletin, which was revised following the December 2023 changes to the Competition Act. These amendments outlined how the Bureau intends to conduct market studies with its new information-gathering powers. Submissions will be accepted until December 23, 2024, and the final version of the Market Studies Information Bulletin is expected to be published in March 2025.

Bureau Seeking Information from Market Participants on Property Controls in the Grocery Industry

- On October 21, 2024, the Bureau announced that it will invite market participants in the food retail and real estate sectors to provide confidential input about the use of property controls in the Canadian grocery industry. The Bureau intends to use these submissions as a part of its examination into how property controls imposed by grocery retailers impact the grocery industry and inform its ongoing investigations into two Canadian grocery companies for their purported usage of property controls. For information on the Bureau’s request for feedback on its preliminary enforcement guidance for property controls, please see the Blakes Competitive Edge: August 2024 Update.

Investment Canada Act

Jinteng Mining’s Acquisition of Peru Mine Receives Investment Canada Act Approval

- On November 5, 2024, Pan American Silver Corp announced that it received approval under the Investment Canada Act for the sale of its 100% interest in La Arena S.A., an entity that owns an open-pit mine and project in Peru, to Jinteng (Singapore) Mining Pte. Ltd., a subsidiary of Zijin Mining Group Co., Ltd. The approval was contingent on an offtake agreement between Pan American Silver and Zijin Mining Group with respect to the project, which grants Pan American Silver 60% of the project’s future copper concentrate for sale in North American markets, once commercial production begins. The transaction is expected to close by the end of Q4 of 2024. For information on Jinteng Mining’s application for judicial review in relation to this transaction, please see the Blakes Competitive Edge: October 2024 Update.

Ministerial Statement Released on the Investment Canada Act Review of Cleveland-Cliffs’ Acquisition of Stelco

- On October 30, 2024, the Minister of Innovation, Science and Industry released a statement approving the American steel production company Cleveland-Cliffs’ acquisition of Stelco Holdings Inc, a Canadian steel company headquartered in Hamilton, Ontario. The investor agreed to commitments relating to maintaining Stelco’s brand, head office location and existing labour and environmental practices, along with capital, research and development expenditures.

Non-Cultural Investments

September 2024 Highlights

- 62 notifications filed (49 filed for acquisitions, 13 for the establishment of a new Canadian business)

- Country of ultimate control: United States (65%); United Kingdom (8%); France (5%); Sweden (3%); Spain (3%); Germany (3%); Italy (3%)

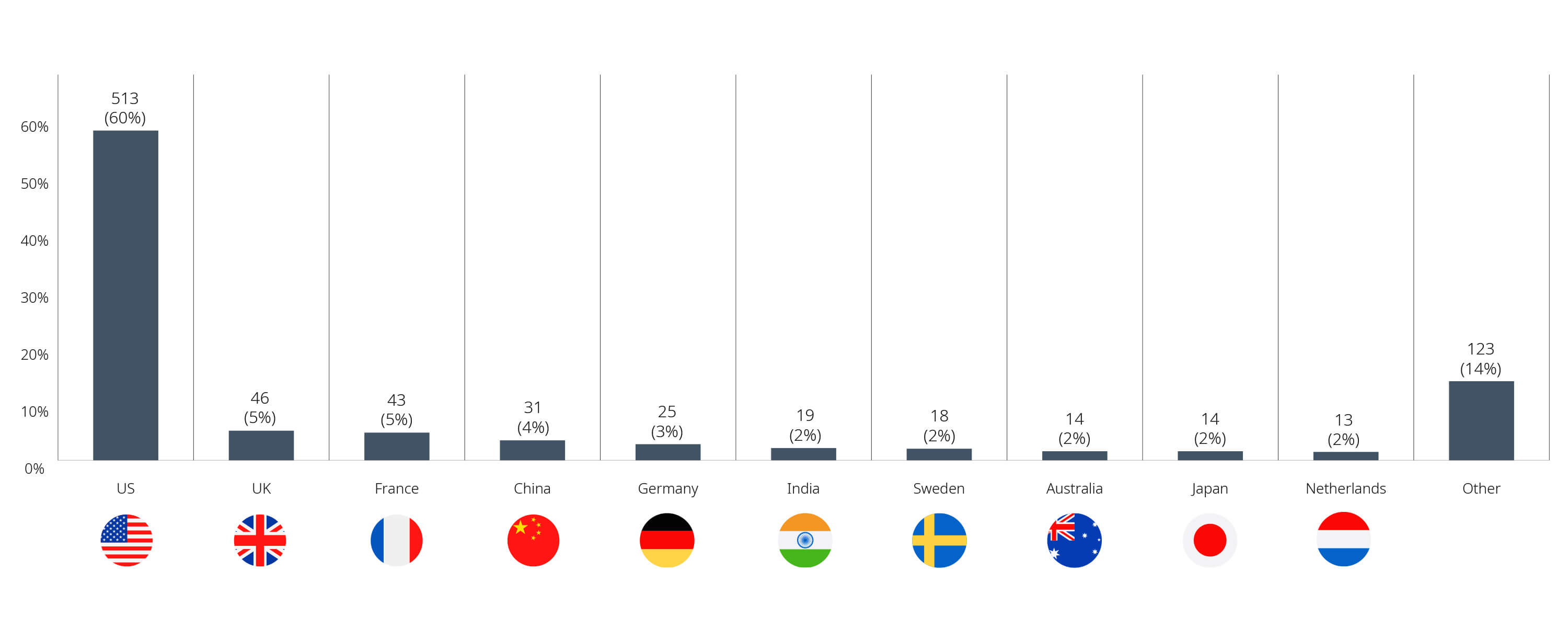

January – September 2024 Highlights

- Three reviewable investment approvals and 856 notifications filed (660 for acquisitions and 196 for the establishment of a new Canadian business)

- Country of ultimate control: United States (60%); United Kingdom (5%); France (5%); China (4%); Germany (3%); India (2%); Sweden (2%)

Blakes Notes

- Browse our thought-leadership insights from the Competition, Antitrust & Foreign Investment group to learn more.

- Browse our Competition Act Amendments page for insights on navigating the recent amendments.

Contact Us

If you have any questions, please do not hesitate to contact your usual Blakes contact or any member of the Blakes Competition, Antitrust & Foreign Investment group.

Related Insights

Blakes and Blakes Business Class communications are intended for informational purposes only and do not constitute legal advice or an opinion on any issue. We would be pleased to provide additional details or advice about specific situations if desired.

For permission to republish this content, please contact the Blakes Client Relations & Marketing Department at [email protected].

© 2026 Blake, Cassels & Graydon LLP